We help our clients to achieve complete Freedom through customized Solutions keeping in mind the Risk Appetite of the client, his/her Cash Flows, Current Commitments, Future Goals etc.

MEET THE CHIEF STRATEGIST

Mr. Rajesh Dossa

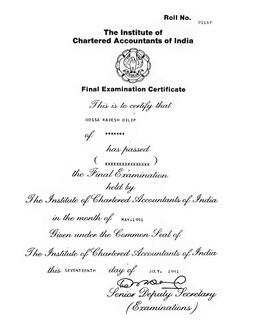

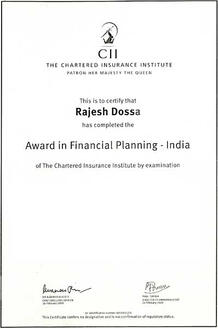

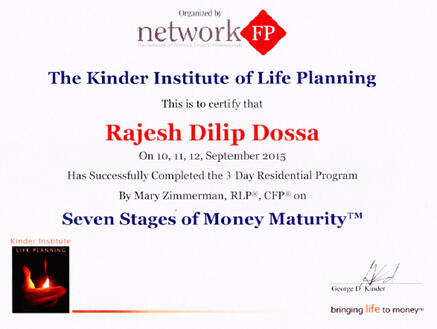

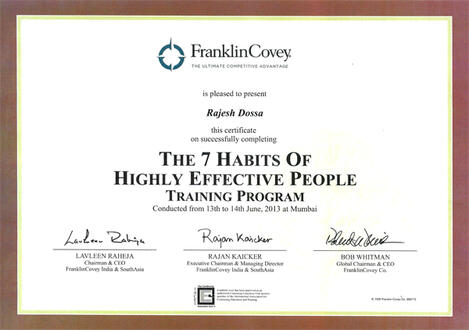

CA CFPCM RCC

We are a team of Chartered Accountant’s (CA) and Certified Financial Planners (CFP). We are Result Certified Coaches (RCC) from the Neuroleadership Group of Australia & have completed our Basic & Advanced training in Life Planning from the Kinder Institute of Life Planning. We are also Retirement Coaches & have deep conversations with clients regarding their agenda Post Retirement. We currently cater to more than 80 families in India & around the World.

our services

The ideal way for us to ascertain as to what services you require is to have a FREE, NO-OBLIGATORY, "Get Acquainted" meet. At this meeting we will get to know each other and ascertain your financial needs/goals a little better. At the end of the Get Acquainted meeting, we will move ahead to the next level only and only if you are comfortable.

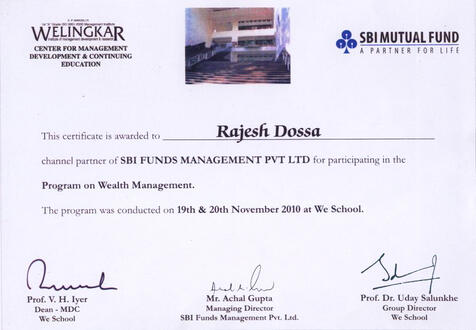

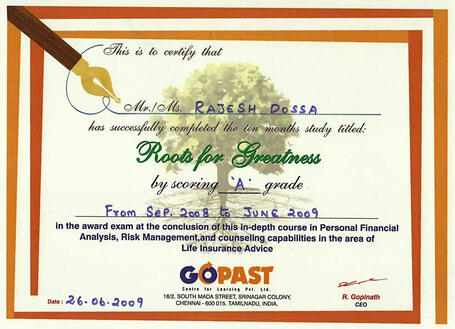

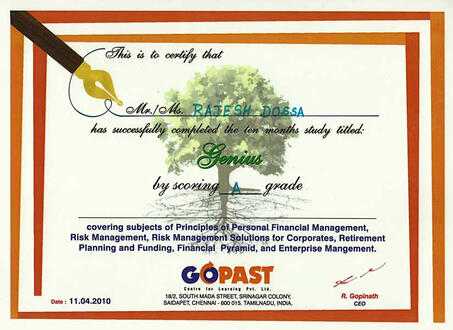

Certifications

Testimonials

"Rajesh is always updated with the products available in the market. He is a patient listener and is always ready to help. His service is prompt and impressive!!"

Top qualities: Good Value, On Time

Urvax Chiniwala - Manager, Ernst & Young

Hired Rajesh as a Financial Advisor in 2009

"Rajesh has done what I could not achieve for myself over years, which is Financial planning for me and putting right efforts in the stock market, Today I am free from tension, worries as he has really planned things for me well, and I have no hesitation sharing with him my plans as his Integrity value is the best. I wish I had him in my life earlier..."

Top qualities: Expert, On-Time

Nilesh Naik - Senior Manager, Tata Consultancy Services

Hired Rajesh as a Financial Advisor in 2007

Life Insurance,Tax and Estate Planning

Life Insurance is your answer to a fundamental question. How will my family manage the challenge of my untimely/early demise?

It’s a subject no one really wants to think about. But if someone depends on you financially, it’s something you cannot sidestep or keep procrastinating on.

What is life insurance?

WHAT IS LIFE INSURANCE?

1. All of us need to understand some basic things about Life Insurance:

2. Life Insurance is a prepared tomorrow and a prepaid retirement.

3. There is no bigger leverage than Insurance.

4. It enables you to retain your Purchasing Power.

5. Life Insurance is a derisking exercise.

6. Life Insurance is a derisking exercise.

7. It is not a religion to believe in

8. Life Insurance is a necessity not a luxury.

9. Nobody can replace the Emotional loss one feels on the demise of a loved one but the Financial loss can be mitigated to some extent by taking an adequate cover.

10. We need to understand that the Assets which we have today were not created overnight rather they were created by sheer dint of hard work over a number of years, so why would we not want to protect what we have created.?

11. Life Insurance is one type of Risk Management. There are two major risks viz dying too soon and living too long. We need to mitigate the possibility of the former occurring at an inappropriate time and also ensure that our Retirement monies definitely outlast us.

This can be done by transferring the risk to the Insurance Company rather than retaining the same. You can then be at peace when you know your immediate family has been taken care of and you are leaving behind only assets, not liabilities.

12. Ability is providing (for your family) while being alive and Nobility is providing even after death.

13. Life Insurance is a dignified savings system which concurrently fuels Nation Development, Family well being and Individual growth.

Investment Management

The key determinant of your portfolio returns will be how your assets have been allocated amongst various Asset Classes.Within those classes, there could be a significant difference on the returns depending upon the product or products you have invested your hard earned money in. Understanding how your Investments are going to move forward into the future will be an integral part of your overall Plan.

What is Asset Allocation?

With product specialization now available to us, we could combine a series of products to achieve the desired objectives. Upon careful analysis of your holdings we would be in a better position to advice you what specific areas would need increase or decrease of allocation.

"Investment is laying out money now, to get more money in future"

== -Warren Buffett- ==

Retirement Planning

If you fail to Plan then You Plan to Fail. The thing to understand here is that contractual regularity is the key. Small amounts on a regular basis will add up to substantial savings.Regularity ultimately leads to Affordability. If you cannot take out a dime out of a dollar you will never take out a hundred thousand out of a million.The nicest thing about NOT PLANNING is that failure comes as a complete surprise and is not preceded by a period of worry and depression.Let it also be understood that we are making our own choices of Retirement every day. Our NOW will determine our Future.

Advantages of Adequate Retirement Provisions

1. Maintaining the Standard of Living that we are accustomed to.

2. Allowing us to lead a life of dignity post retirement.

3. Being independent of the two C’s viz Children & CharityRoadblocks to Retirement Planning:

1. Spending more and saving less. The ideal way to go is to adopt the

”income – savings = expenses” route. But most people adopt the ”income – expenses = savings” route.

2. Unexpected and unforeseen expenses for e.g. medical expenses.

3. Inadequate insurance cover.

4. Premature use of Retirement funds for children’s marriage etc or for maintenance of lifestyle of family.

5. The clear and present danger is that most people may outlive their Retirement monies, thereby being forced to resort to Reverse Mortgage for survival.

"The only person who can take care of older you someday - is the younger you are today"

World Class University funding strategies

Today the outlay required for World Class Education is increasing. As parents all of us may compromise on the quality of life we have for ourselves or our children.For e.g. we may postpone buying of a car or the latest plasma TV or we may travel by train and not by air but we shall NEVER EVER compromise on the quality of education we give our children.The Knowledge Economy that we are in also magnifies the need for ensuring that we/our children have the resources for the investment necessary for World Class Education.The way to go is to start early, have the first mover advantage and allow the Power of Compounding to work in our favor. The Endeavour should always be towards being a perpetual student for the rest of our lives. Learning should always be a Journey & not a Destination.

"The cost of preventing mistake is generally much less than the cost of correcting mistakes"

== - PM Box Guide - ==

risk analysis

You may already have a plan in place, but are unsure if your plan will help you reach your desired goal, in which case we can help you by checking if you are on track.Some of the key themes could be:

1. An estimate of the amount to save for Retirement.

2. A college savings plan with specific Recommendations.

3. Exploring “what if” scenarios such as “is Am I on track for my regarding Savings?”

4. Answering specific questions you mayhave on several issues

Testimonials

"Rajesh is always updated with the products available in the market. He is a patient listener and is always ready to help. His service is prompt and impressive!!"

Top qualities: Good Value, On Time

Urvax Chiniwala - Manager, Ernst & Young

Hired Rajesh as a Financial Advisor in 2009

"Rajesh has done what I could not achieve for myself over years, which is Financial planning for me and putting right efforts in the stock market, Today I am free from tension, worries as he has really planned things for me well, and I have no hesitation sharing with him my plans as his Integrity value is the best. I wish I had him in my life earlier..."

Top qualities: Expert, On-Time

Nilesh Naik - Senior Manager, Tata Consultancy Services

Hired Rajesh as a Financial Advisor in 2007

"I must say that Rajesh really brings in the Change in life that secures you from current as well as future financial commitments by meticulous Financial Planning.Best thing about him is that builds Investment plans that guarantees a secured future not by sacrificing current life style but by instilling discipline in your current Financial behavior.Another thing that also takes him in a different league is his commitment and follows up in implementing the plans. He takes you from drawing board to realization, in a very timely but flexible and effortless manner. Hats off to you Rajesh"Top qualities: Great Results, Expert

Manish Patki - Senior Manager, Tata Consultancy Services

Hired Rajesh as a Personal Finance Consultant in 2008, and hired Rajesh more than once

“Rajesh has a unique style of making one aware of the need for structured financial planning. He is very personable and understands the client's needs perfectly. He is dependable and trustworthy. All in all, he has everything that you would want from your financial consultant! Recommend him to everyone, especially folks in Mumbai area...”

Top qualities: Expert, On Time

Mittal Sachin - Project Manager SAP, Satyam Computer Services Ltd.

Hired Rajesh as a Financial Advisor in 2010

“Rajesh comes up as a person with the gift of the gab and at the same time, he is honest and straight forward which increases the trust factor in him. His knowledge on his subject is deep and impeccable and I wish him best of luck for his future endeavors”

Top qualities: Personable, Expert, On Time

Shailendra Shukla - Country Sales Manager, A P C C

Hired Rajesh as a Financial Advisor in 2009

“Rajesh has detail in-depth knowledge about Financial Markets & Products. And his expertise with the Life Insurance products also helps one construct a perfect & healthy financial portfolio. Have utilized Rajesh's expertise multiple times & benefitted immensely. I wish Rajesh much more success in his endeavors & helping everyone build a healthy & safe financial portfolio. Good luck!!”

Top qualities: Great Results, Expert, Good Value

CA Ajay Mehta - Director, PAMAC Finserv

Hired Rajesh as a Financial Advisor in 2000

“Rajesh is extremely professional and is always available whenever required. He understands the complete profile of his clients and gives personalised advice.”

Top qualities: Great Results, Expert

CA Neville Motafram - Senior Manager, Accenture

Hired Rajesh as a Financial Advisor in 2009

“Rajesh is a very helpful person and is a good financial advisor He has an in-depth knowledge of the subjects/business he deals with.”

Top qualities: Expert, On Time

Kaushik Moitra - Manager HDFC ERGO

Hired Rajesh as a Financial Advisor in 2010

“Rajesh was pleasant to interact.I value his financial advice.”

Top qualities: Personable, Expert, Good Value

UK Rajesh - Asst VP, HDFC Bank

Hired Rajesh as a Financial Advisor in 2009

“Rajesh has been assisting me with financial planning for over an year now. I really appreciate Rajesh's in-depth knowledge about various products in the Insurance and Financial sector. What has impressed me post is his ingenuity in providing the correct advice regarding selecting various products and his energy to ensure that his clients get the best and on-time. Overall, I am very impressed with Rajesh and wish him Good Luck!”

Top qualities: Personable, Expert

Harshad Borgaonkar - Manager, Cap Gemini

Hired Rajesh as an Insurance Agent in 2009

“What makes Rajesh's approach towards financial planning unique is his belief that right financial approach can make a difference to an individual's quality of life. This belief is clearly visible in interaction with him given the kind of solutions he comes up with to meet client's financial needs. He is always available and renders his services with utmost professionalism.”

Top qualities: Expert, On Time

CA Sujit Modi - Vice President, Deustche Bank

Hired Rajesh as a Financial Advisor in 2010

“Mr. Rajesh Dossa is a professional with a dedicated purpose. He takes a keen interest in each client he deals with and approaches his work with passion. He adds value to each person's life by giving new dimensions to think about"

Top qualities: Expert, On Time

CA Samir Shah - CFO HDFC Ergo General Insurance

Hired Rajesh as a Financial Advisor in 2010

“I strongly recommend Mr. Rajesh Dossa”

Top qualities: Expert, On Time

Kashyap Dakshini - National Manager, Accidents and Health, HDFC Ergo General insurance

was with another company when working with Rajesh at LifeStrategies

“I strongly recommend Mr. Rajesh Dossa”

Top qualities: Expert, On Time

Kashyap Dakshini - National Manager, Accidents and Health, HDFC Ergo General insurance

was with another company when working with Rajesh at LifeStrategies

“Its been a pleasure working with Rajesh for my financial planning for last year or so. He was the person who exposed me to various options that I can use to secure my and families' future and so far all his recommendations have made sense.Most impressive has been his attention to details, concern for others, knowledge of the products in insurance and other financial planning domain, and punctuality he displays in his interactions.

The key to the whole relationship is his ability to empathize.”

Top qualities: Expert, On-Time

Dhananjay Redkar - Manager, Barclays

Hired Rajesh as a Financial Advisor in 2009

“Rajesh has an in-depth knowledge of his field and aims to deliver the best results for his clients and friends. Service is personal yet professional.”

Top qualities: Personable, Expert

Dharmesh Shah - Manager, RosyBlue Antwerp, Belgium

Hired Rajesh as a Financial Advisor in 2007

“Rajesh's approach to understanding the client needs is unique in terms of understanding what makes each of us tick

The advice provided is unbiased, specific than generic, and has a long term approach.”

Top qualities: Personable, Expert

Subir Bisht - Vice President, Morgan Stanley India Capital

Hired Rajesh as a Financial Advisor in 2010

About Us

Hi! Welcome to LIFE STRATEGIES. We thank you for investing your valuable time in visiting our website. We hope you'll spend a few minutes getting to know us and how we can work together to help you achieve Abundance.We are in the Life Planning business and we help our clients to achieve complete Financial Freedom through customized Solutions keeping in mind the Risk Appetite of the client, his/her Cash Flows, Current Commitments, Current Investments, Future Goals, etc.We believe in Creating Value and making a Positive Difference in the lives of people we touch. We believe each client is unique, hence we put CONTEXT around our Clients Goals & Objectives. We do not come to any meeting with a Preconceived Notion. We would rather get to know the person, explore ways we can work together, understand his/her Concerns/Challenges, Goals, Aspirations etc. Our only agenda is Creating Value for the CLIENT.This Value Creation is a two step process wherein in the First Meeting we share certain Ideas and Concepts and conduct Analysis

If after this process the prospect is comfortable then only we move to the Second stage. Before the Second meeting the Strategyis prepared keeping in mind the Risk Appetite, Cash flows, Current Emi's if any, Current Investments etc.During the Second Meeting a Review of the First meeting is done and then a Blueprint Cum Strategy is presented wherein we lay out the best possible Road Map with the" Least Possible Risk Route" to achieve the desired Goals/Objectives of the Client. Once the person wishes to go ahead we take steps towards the Implementation of Strategy we are a 100% online paperless office & we provide Log In id’s/ Passwords & Apps for the client to view the investment.After this, there is an Annual Review wherein we review the performance of the recommendations of the Asset classes in the year gone by and make changes if necessary. As mentioned earlier the idea is make a Positive Difference in the lives of people whom we touch through a Value Creating and Holistic Process.Continuous process of refinement and competence is our duty towards our Customers, which is why we are constantly upgrading our Knowledge and Skills. The idea is to be perpetual students so that we can deliver the best of services& strategies.The business is run jointly by my wife Sonal, along with a team of EIGHT Individuals, and me. Please view the Services page.Please feel free to contact us for more information, any questions you have, or to schedule a FREE NO OBLIGATORY first meet by prior appointment. We look forward to meeting you. Have a ROCKING day, Live with PASSION and CARPE DIEM (SEIZE THE DAY).

Contact Us